Accounting 101

“Debits and Credits

and why they can sometimes be confusing”

After writing the TaccountTool, a program to help students with accounting homework using T accounts, I have occasionally received requests asking for help in understanding the whole debit credit thing of accounting. Therefore, I am writing this explanation which I hope will be helpful.

First, let’s talk about the basics of debits and credits and, then, I will try to explain why they can sometimes seem confusing.

The terms debits and credits have no real profound meaning that I can think of. (Actually, there are some latin roots we could explore, but who cares.) For our purposes, it’s just a fancy way for accountants to say left or right.

---------------------

The double entry accounting system began a very lont time ago. Some say it was the Egyptians, others earlier.

The concept of debits and credits is similar to the laws of physics in that every action has an opposite and exactly equal reaction. And, that everything must always be in perfect balance.

The double entry system in accounting is based on this idea. For every debit there must be an opposite and exactly equal credit.

In accounting, it’s simply this, if you add up all of the debits and subtract all of the credits the answer should always, always, be zero. In other words, debits and credits are always in balance. If you ever add up all the debits and subtract all of the credit amounts and come up with anything other than zero, you have a problem …somewhere.

In order to demonstrate this accountants often use what are referred to as T accounts, or mini balances. The term “debit” is used to refer to the left hand side of the T and “credit” to the right hand side. It’s that simple.

To throw in a little fanciful sometimes debits and credits are abbreviated as “Dr” and “Cr”. (So how in the world do we get “Dr” from the word debit? “Dr” comes from the old latin form of the word “debere”. Again, for our purposes, we don’t care. Just remember - debits on the left, credits on the right.) Ok, on with the show.

Every accounting transaction must always be in balance between the left hand side and right hand side of the balance, or, T, regardless of how many Ts or how many accounts are used. Total debits always equal total credits.

Accountants often use T accounts, or mini balances, to work through accounting entries to make sure what they are doing is in balance. For example, if you were to make a sale of $1,000 the entry could be displayed as follows:

The entry is in balance because total debits equal total credits.

By their nature, some accounts will typically have a net debit balance and some accounts will typically have a net credit balance.

The following diagram shows the typical account balances:

By referring to the diagram above you can see that a current asset account will typically have a debit balance, a liability account a credit balance etc. Always keep in mind that regardless of how many accounts and account balances you may have, all debits and credits, if netted against each other, should always yield zero.

The diagram above can also be used to show the type of entry used to increase an account balance. For example, a debit entry will increase a current asset account, while a credit entry will increase a revenue account. So, to recognize a cash sale of $2,500.00 you would debit cash, a current asset, and, since every entry must balance, you would also credit Sales, a revenue account. The T account representation of this transaction would look something like the following:

Assume that you buy 9,500.00 of inventory on account, meaning that you take possession of the inventory now but will pay for it later.

The entry would be as follows:

(Referring to the diagram above, you will see that debits increase current asset accounts, in this example Inventory, and credits increase current liability accounts, accounts payable in this example.)

Now assume that you sell 5,000.00 of that inventory for 7,000.00. This transaction requires four entry items.

First, two entry items (a debit and a credit) to recognize the sale of 7,000.00, and second, two entry items (a debit and a credit) to reduce the inventory by 5,000.00. In the diagram below, I am intentionally not showing the titles “dr” and “cr”, because you don’t need them. (Remember debits are on the left hand side, credits on the right hand side.)

Again, all debits and credits are in balance and would net to zero if you subtracted all of the credits from all of the debits.

How to decrease an account balance:

To decrease any account you use an entry that is opposite of the type of entry that is used to increase the account. (Refer to the diagram above.)

In the last example we needed to decrease inventory to account for the inventory that went out the door as a result of the sale. Since inventory, a current asset, is typically increased with a debit, we decrease inventory with a credit entry. In this case, the 5,000.00 credit to inventory reduces the inventory balance as it is now owned by some one else. And, since for every credit there must be a debit, the offsetting entry is to cost of sales which is increased with debits, see diagram above. Everything is in balance, debits equal credits.

Another example. “John Doe” at the beginning of the year pays 6,000.00 cash for two years rent. At the end of the first year, he records the entry to reflect that he only has one year left of pre-paid rent. The beginning-of-year and end-of-year entries would be as follows:

Again, debits and credits are always in balance.

What causes some confusion:

Ok, if you are comfortable with the above, let’s look at what I believe can be the cause of some confusion with regards to debits and credits.

It’s completely and simply a matter of the perspective. The perspective of from who’s side of the transaction you are viewing things.

If you are taking your first accounting class and are new to accounting, what you have heard about debits and credits your entire life up until now is probably almost nothing. Almost nothing that is, except scattered pieces you have heard on occasion as you hear others use the terms debit or credit. (Note: this discussion may require a bit of mental re-programming on your part.)

Remember in the diagram and discussion above that cash is increased with a debit and decreased with a credit. That being the case, why is it then, that when you go to the bank and make a deposit for $100.00 that the bank teller says, “… thanks for the deposit we have credited your account $100.00”?

Sounds like this conflicts with our premise that debits increase cash and credits decrease cash doesn’t it. It sounds like it, but, it really doesn’t. It is just a matter of perspective, the bank’s perspective, or, yours.

To see why, let’s look at the above transaction from both perspectives. Assume you make $100.00 from a cash sale and deposit the money in the bank.

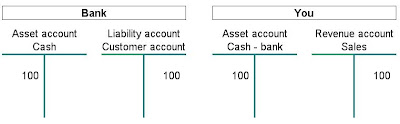

The bank:

Increases its cash on hand, an asset, by $100.00, and, at the same time has to recognize an obligation that it will pay you your money back upon demand, an obligation or liability. I.e. a debit and a credit.

You:

Record a sale and increase your cash balance by $100.00.

Here is how each party would record the transaction.

The bank tracks their obligations to individual customers in liability accounts. That’s why the bank teller will tell you that they have received your deposit and have “credited” your account. True, all true. That is exactly what they did. They recorded a liability with your name attached to it.

It’s no wonder that after hearing that your account has been “credited” for years that when we hit our first accounting class and hear that a debit increases our cash we are confused.

The point here is that we need to keep in mind the perspective from which we are talking about or looking at a problem. From who’s perspective are we looking? Answer that question first, and then apply the diagram shown above showing which type of entry typically increases or decreases the account balance. That’s it!

Ok, just to make sure. Here is another example. Let’s say your credit card company mistakenly charges your company a $25.00 service fee. Not good.

Initially, both you and the credit card company record the charge, but, after some discussion, you finally convince the credit card company that the fee was incorrectly charged and they agree to remove the charge telling you that they will “credit” your account. Look at the transactions from both perspectives in two steps. Step 1) both you and the credit card company record the fee, and step 2) both you and the credit card company remove the fee.

Forgetting to remember from what perspective you are looking at a transaction, or, from what perspective someone else may be coming from, is what I believe causes some confusion for beginning accounting students with the terms debits and credits.

In step 2 above, the credit card company would tell you over the phone that they have credited your account and have removed the service fee. Keep in mind that to them your account is a receivable, a current asset which is typically increased with debits and decreased with credits. Therefore, when they removed the erroneous charge that had hoped to collect from you, they credited your account – which to them is a receivable account. If you look at the above transaction and put your self in their shoes, the transaction from their perspective should become clearer.

On the other side of the coin, in step 2, you reduced your liability to pay the credit card company by 25.00 by debiting your liability account by 25.00. And, since for every debit there must be an opposing credit, you reduced your expense by crediting your expense account. From either perspective debits and credits are in balance.

I hope this makes sense and has been helpful.

http://www.taccounttool.com/